Understanding Solana's Economics

Introduction

Solana's momentum in 2025 is undeniable. Over the last year it has consistently dwarfed every other chain in almost every metric. Why? Because it puts the develoepr experience first. It's developed an understanding of what developers need to build apps at scale. That focus keeps its network‑effect snowballing.

But if you're staking SOL, the yield you receive has to have come from somewhere. In fact, the yield you earn is designed to incentivise people to work together and keep everything secure.

In this post, we'll look into Solana's economics. We'll dive into its three core drivers:

- Transaction Fees: How network activity creates economic momentum.

- Inflationary Rewards: The incentive for stakers to keep the network secure.

- Maximal Extractable Value (MEV): The extra value captured from transaction ordering.

We'll explore how these pieces work together and what makes Solana stand out. By the end, you'll have a high-level understanding of how the network stays secure and why staking SOL plays such a vital role in its economy.

Why Solana is Winning

Like it or hate it, everything will be tokenised. Digital tokens offer a much better way of expressing yourself in almost any financial transaction. It's peer to peer, inherently global, and programmable. These features create the neccessary conditions for an internet-alternative 'system' for commerce. It's a system that doesn't descriminate based on your human privileges. There isn't a better system that can handle payments and value trasnfer for AI agents, let alone it's benefits for humanity.

But what does an internet-alternative opearting system for money look like? Well, Bitcoin is already an operating system for digital gold. It's secure, and simple. It's not trying to be anything but Bitcoin. Ethereum was the first blockchain to offer more interesting features, making it easier to create and interact with tokens, bringing in a tidal wave of developers. Bitcoin also had this with coloured coins, but the developer experience was mid.

Solana, like Ethereum, allows you to create and interact with tokens and other apps within a connected programmable sandbox. It's all public, but you can opt to keep transactions private if needed. The difference with Solana is that it has been designed in a way that removes barriers for developers, while compromising on some of the decentralisation features that make Ethereum unique. So far, those compromises have been well worth the squeeze and is the core reason why Solana has overtaken Ethereum on a number of metrics. Developers bring users. It's all about developers.

Yes there are countless other chains trying to build this. No they do not have anywhere near the network effect that Solana or Ethereum already have. The sole reason Solana has been able to outperform everyone is because of its unwavering focus on what developers need to build apps that scale. In 2025, other blockchains are just starting to figure out that THIS is the only thing that's going to push the industry forward. You can have the most decentralised network, the most extravagant marketing strategies that include hacker houses and top notch developer events and conferences. But in the end, it only works if developers want to build there.

Transaction Fees

Every transaction on the Solana network is a request to change the state of its shared state (shared state, shared ledger). If I send you $10, what I'm essentially asking is, "Please change the state of the blockchain so that I have $10 less and you have $10 more." That request, whatever the transaction may be, gets sent to a validator who then does a number of checks to make sure the request is valid. It checks whether the person sending that request has the permission to do it (do they have the private key that corresponds to the public key address they want to change the state of?). It also checks to see if they have enough funds to make the request.

All of this 'checking' work is paid for to the validator via a tiny transaction fee. Those transactions fees get passed on to users delegating to Solana validators, and the cost of doing business with people via Solana becomes significantly cheaper. This only works if transactions are cheap. That's why Solana's entire roadmap is 'IBRL'. It's about making fun of roadmaps, but it's also about making blockchains cheaper to use than Visa, all while increasing financial access and disrupting the need to trust an institution between you and your business target.

The fees you pay on Solana go to the validators who process the transaction. But it's more nuanced that that. So let’s break down how transaction fees work on Solana:

- Base Fee: Every transaction pays a base fee of 0.000005 SOL. This is a flat minimum fee required for a transaction to be processed, and it’s designed to prevent spam. The base fee is split by the protocol: 50% is burned (permanently destroyed) and the other 50% is given to the validator who produced the block.

- Priority Fee: Users have the option to pay an additional fee on top of the base fee. This is basically a tip to the validator to increase the chances of the transaction being included quickly, especially when the network is busy. The priority fee is set by the user (or their wallet) by specifying a price per “compute unit” (a measure of transaction compute cost). In times of congestion, users competing for block space will raise their priority fee bids. 100% of these fees no go to the validator processing the transaction.

The key takeaway is that validators only get paid if people are using the network, and that Solana’s fee revenue is somewhat elastic – meaning fees grow the more Solana gets used. Over the long run, if Solana achieves massive adoption with millions of daily transactions, these fees could become a major source of rewards, even as inflation drops. In fact, the design intention is that transaction fees will gradually take over as the primary reward source as inflationary issuance declines.

This is easily the most incentive-aligned source of revenue for teams building on Solana. Validators only make money when the network is busy. Therefore, validator opeators are incentivised to bring new developers into the ecosystem and build their own products on Solana, becoming part of it's growth story. Access to these rewards for delegators will be shared by validators after implementation of SIMD-0123. Reagrdless, Solana's fee mechanism provides a lucrative flywheel for delegators that will continue to reinforce Solana's dominance in the near future.

Inflationary Rewards

Inflationary rewards make up the bulk of the reward you earn as a staker right now. At the end of every epoch, Solana automatically distributes SOL to all staking delegators. These rewards are inflationary because they dilute all SOL that exists. Each epoch (approximately every 2 days), new SOL is created and distributed to all stakers (validators and their delegators) as a reward for securing the network. If you're holding SOL on an exchange or holding your SOL in a wallet without staking it, you're losing out on at least 5% (as at May 2025) of its purchasing power per year in today's terms. This difference is going directly to those who are staking. Put differently, if you're not staking, you are the yield.

In real terms, non-stakers “pay” stakers via inflation, as those who don’t stake see their share of ownership of the total supply slowly decrease. Keep in mind that 5% is what you're missing out at the current SOL valuation in dollar terms. As the price of SOL rises, the opportunity cost in dollar terms also increases.

These rewards are distributed automatically to stakers at the end of every epoch. The protocol automatically adds the earned SOL to your staked balance (so your stake grows, compounding over time).

The inflation rate you actually earn depends on a number of variables:

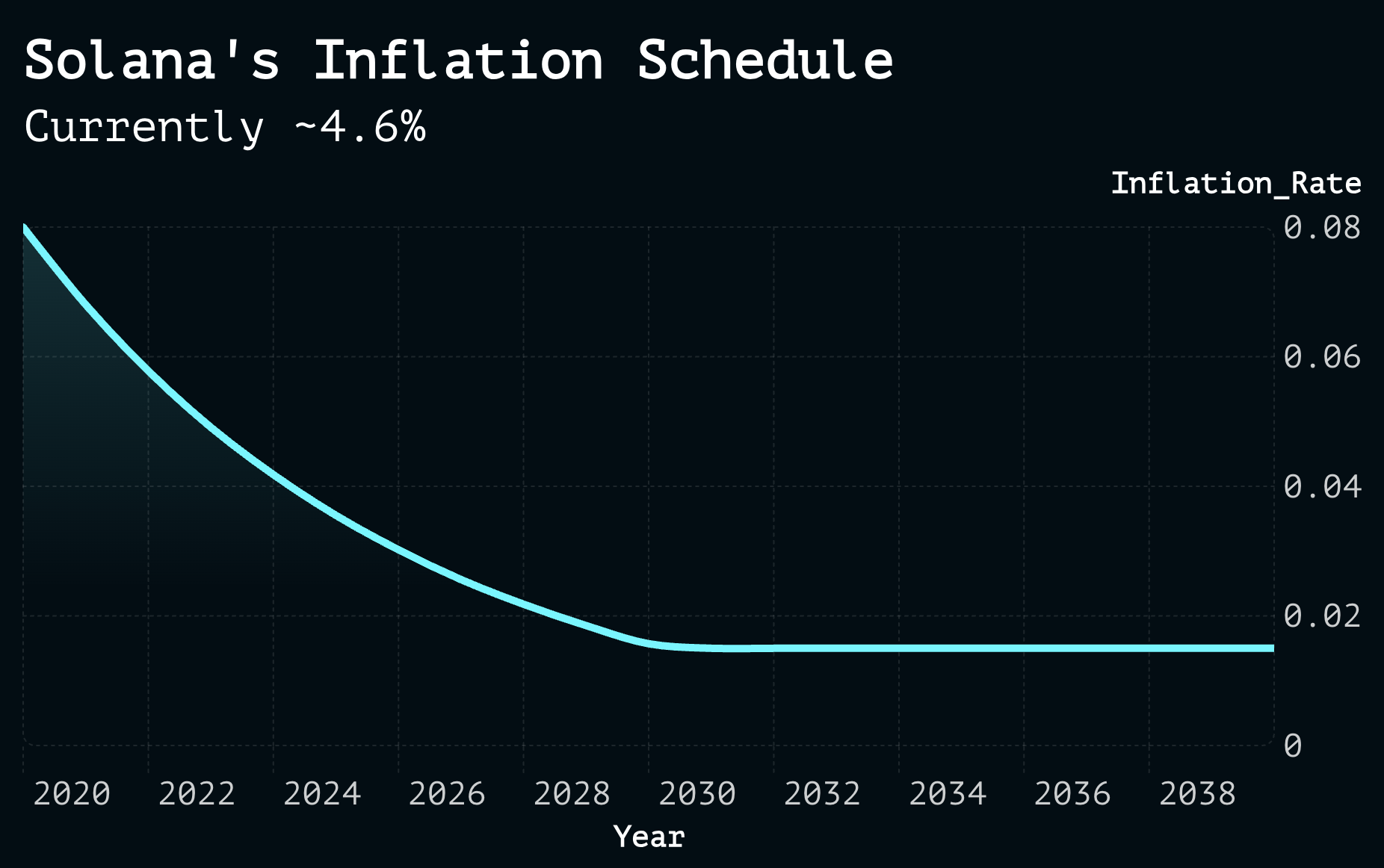

- Global Inflation Rate: This is built into Solana's design and is set to reduce over time, starting with an initial rate of 8% in 2020 that has been reducing by 15% per year and will eventually stabilise at a long-term steady state of 1-2% p.a.

- Stake Percentage: How much SOL that is circulating is staked vs unstaked? This ratio directly impacts the rewards you receive. The larger the percentage of SOL's circulating supply is staked, the lower the potential rewards you will receive.

- Commission Rate: Some validators charge a commission on the inflationary rewards earned by their delegators. Blockport maintains 0% commissions on these rewards. We beleive validators should be paid via incentive-aligned sources tied to network activity.

- Validator Performance: This is why choosing the right validator is important. Part of the calculation that allocates these rewards looks at validator performance. If you're staked to a poorly performing validator, it's possible they may skip designated slots to produce transactions, or go offline, thus reducing the amount of inflationary rewards their stakers receive.

In practice, this is implemented per “epoch-year” (every ~182 epochs, roughly one calendar year). For example, if inflation is 5% this year, it would be 15% lower (around 4.25%) next year, and so on. As the chart above illustrates, the biggest declines happen in the early years. Around 12–15 years after launch, inflation is expected to settle at 1.5% and remain there. As of early 2025, Solana’s annual inflation rate is already down to roughly 4.6% and shrinking each epoch-year toward the target. This design provides high rewards for Solana’s early growth phase and gradually transitions to a low, steady inflation in the long run.

Think of this as the reward that Solana pays you to support its economic security. After all, the purpose of staking is to make it unfeasible for attackers to make unauthorised changes to the network. Solana's economic design met its goal of good providing economic security, in fact some argued recently that it's currently 'too secure' by way of overpaying for that security via a generous inflation schedule.

MEV (Maximal Extractable Value)

In addition to transaction fees and inflationary rewards, Solana validators can earn extra income via MEV, or Maximal Extractable Value. MEV refers to the additional value a block producer can extract by cleverly ordering, including, or excluding certain transactions in the blocks they produce. In many blockchain ecosystems, MEV is often associated with arbitrage bots, sandwich trades, and other 'opportunistic' transactions that profit from how transactions are sequenced. MEV is not always purely adversarial, and on Solana has become an important revenue stream for stakers and validators. MEV on Solana requires specialised adjustments to the validator client. The leading solution (used by Blockport) for this on Solana is Jito – a custom validator client that implements an off-chain MEV marketplace. Here’s a simplified overview of how MEV extraction works with Jito on Solana:

- Traders find opportunities: A trader (also referred to as the mysterious 'searchers') use programs to automatically monitor and spot profitable on-chain opportunities. They're looking for arbitrage, liquidations, sandwich attacks, and 'good' MEV.

- Bidding via bundles: The searcher packages these transactions into what Jito defines as 'bundles' and submits them to Jito's MEV marketplace – basically offering a tip (in SOL) to any validator who includes that bundle in a block. Multiple searchers might be competing for the same transaction, each with their own bundle and tip.

- Validator selects the highest tip: When a jito validator is the leader for a block, it runs an auction for the received bundles. The bundle with the highest offered tip wins, and the validator inserts those transactions into the block (ensuring they execute atomically in the specified order).

- Tip is paid to the validator: In exchange for including the bundle, the validator earns the offered MEV tip from the searcher. This reward is then shared with the validator’s delegators automatically. Essentially, the validator and its stakers get paid for facilitating the searcher’s profitable transaction.

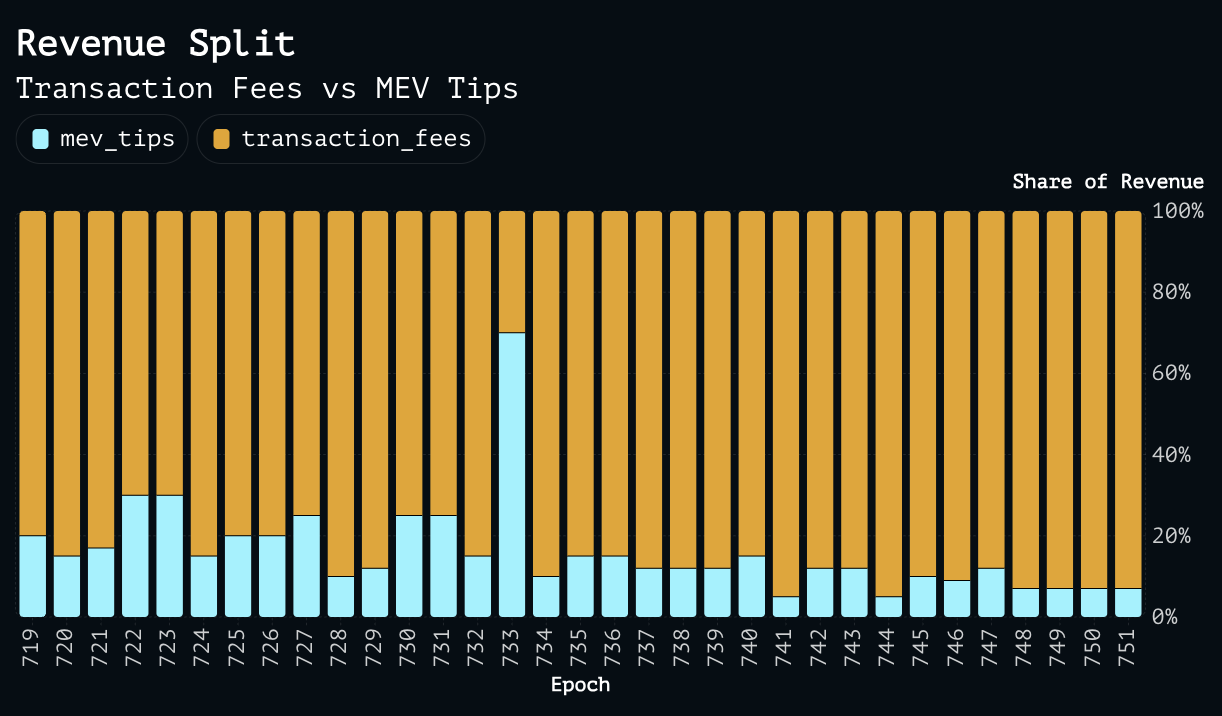

Currently, Blockport shares 92% of our MEV revenue with our stakers. This 8% cut we make from MEV tips alone has been a major share of our revenue over the last year as shown in the below chart.

By participating in MEV auctions, a Solana validator can capture additional value for its delegators that would otherwise be exclusively given to the insiders making the trade. Validators running the Jito client have been able to increase their rewards by a healthy margin thanks to MEV. But it only really pays when there's people using Solana.

It’s worth highlighting that not all MEV is bad for the ecosystem. Some MEV strategies actually make Solana more efficient – for example, arbitrage bots that quickly balance prices between exchanges ensure traders using Solana get consistent prices. That said, certain MEV tactics (like "sandwich attacks" that front-run user trades to extract profit) can be harmful. The Solana community has shown a strong willingness to minimize harmful MEV. There are some great dashboards now that offer great insights into MEV on Solana.

Conclusion

Solana’s economics have three reinforcing pillars: ultra-low fees, a generous inflation schedule that rewards long term stakers, and a very active community of validators around the world. As the network continues to grow, and as blockchains grow into their product market fit, everyone wins.

Drop into our Telegram and say hello.